Hello dear Shoppers !!!

Nowadays you can see contactless debit / credit cards and contactless payments from the phone are quite in common in India.

But why is that so?

Are they easy to use or they are more secured or there are some more reasons that more people are shifting to mobile transactions or card contactless payments?

Well, we all know the answers to these questions. Banks are issuing these cards to users to make successful digital payments. Now, you don’t have to stand in the queue and wait for your turn to pay and then wait to get the change from the shop owner.

Contactless payment has eliminated these steps thereby providing quicker and faster transactions.

And guess what! You really don’t need to worry about the security of these transactions as these transactions are highly encrypted.

In this article, I am sharing about what contactless payment is, what are the popular contactless debit card in India and contactless payment apps, how to pay using this technology through cards and your phone and the daily limit for these transactions in a very simple way.

After reading this article, you’ll have a clear understanding of this concept and essential information related to contactless debit cards, including the limits associated with contactless payments.

Table of Contents

1. What is contactless payment?

It is a quicker way to pay with your credit/debit card or phone by just tapping or hovering it on the contactless payment terminal. You don’t need to swipe your card or enter a PIN, thus, making this payment way faster than the other payment methods.

You will need to check the “Wifi” like symbol both on the card and the POS terminal to ensure that both are enabled for contactless payment.

With this, you can breeze through transactions swiftly and effortlessly. Just a simple tap, and you’re done!

Many people find this method convenient, as it eliminates some of the steps, making buying things a lot smoother.

This method uses NFC/ RFID technology for faster transactions and it is more secure as it hides your card info.

2. What is contactless debit card?

Contactless debit cards are very convenient to use. These debit cards are not only used for contactless payments but you can also swipe it to make your payment.

There is some amount limit for using contactless payment feature after that you have to swipe your card in order to complete the transactions.

Information related to the contactless payment limit is discussed below in this article. Please check contactless payment limit section below to know further.

So, are you considering having this debit card?

Well I guess. Yes!!

In India, leading banks like SBI, Axis Bank, ICICI Bank, and Kotak Mahindra predominantly offer contactless debit cards. The primary issuers of these cards are Mastercard, Visa, and RuPay, encompassing the major players in the country’s financial landscape.

Let me talk about them in more details –

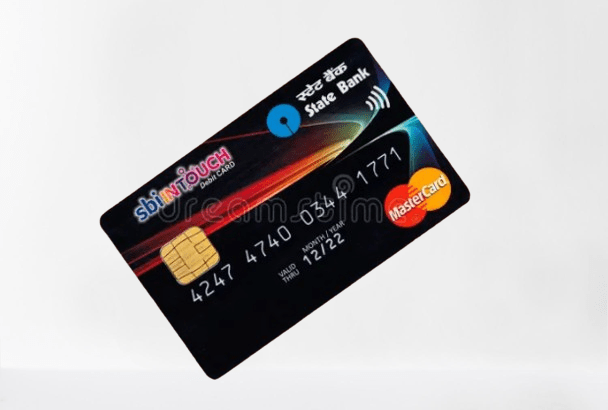

A) SBIIntouch Tap and Go Contactless Debit card

As per Bank Bazaar, this card boasts a user base exceeding 10 lakh individuals in India and is accepted by over 30 million merchants worldwide. To obtain this card, you simply need to open an account with SBI Bank in India.

Daily limit

- Transaction limit – up to Rs. 75,000

- Withdrawal limit – up to Rs. 40,000.

In addition to shopping, this card offers versatility, allowing you to purchase movie tickets, pay for airline, bus, or train tickets, and even withdraw cash from ATMs.

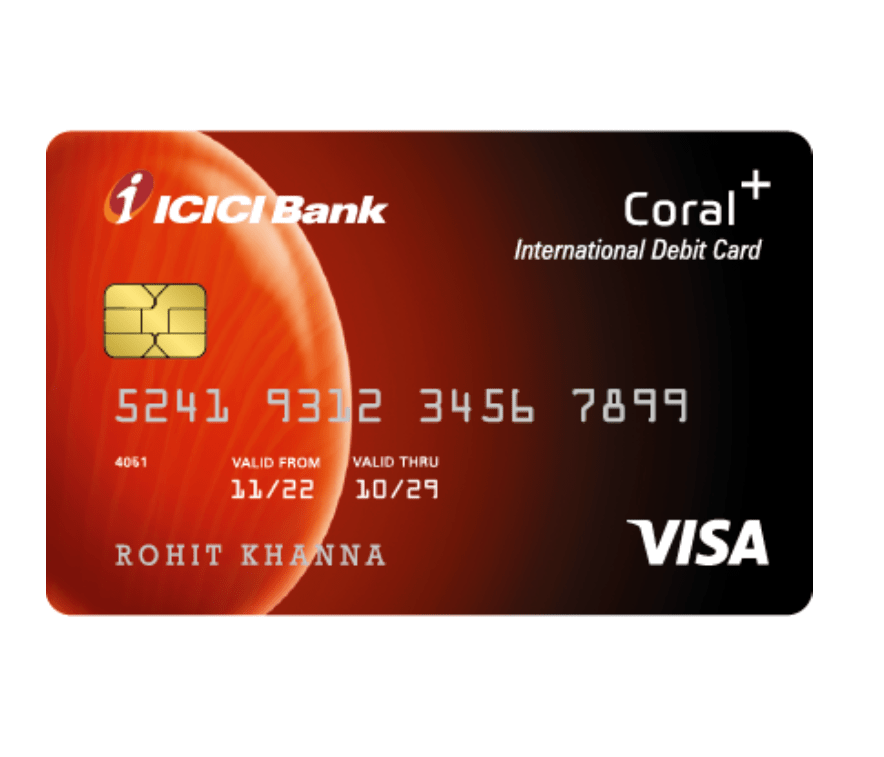

B) ICICI Coral Paywave Contactless Debit Card

Similar to the benefits offered by the SBI Intouch Tap and Go debit card, this card also allows you to book flight and movie tickets, enjoy airport lounge access, and conveniently make payments for your shopping.

You can use this card for both domestic and international transactions.

The current daily spend limits on your card

| ATM limit | Transaction limit | |

| Domestic | Rs.1,50,000 | Rs. 5,00,000 |

| International | Rs. 1,50,000 | Rs. 2,00,000 |

Moreover, you can enjoy enticing discount offers on shopping and delicious restaurant meals. For more details, visit the official website of ICICI Banks offical website.

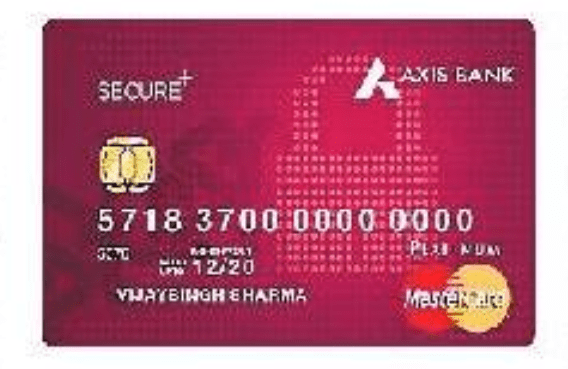

C) Axis Bank Secure + Contactless Debit Card

While you can use this card for shopping, it’s important to note that, as per RBI norms, the current contactless payment limit is Rs. 5000 per purchase. For transactions exceeding this limit, you’ll need to enter your PIN.

With this card you’ll also get 15% discount at partner restaurants when you dine out.

The customers will also get protection up to Rs. 75,000 cover in case of any financial fraud.

Daily Limit

- Withdrawal limit – Rs. 50,000

- Purchase Limit – Rs. 2,00,000

D) Kotak Privy League Platinum Contactless Debit Card

This card provides you 15% discount on a minimum order value Rs. 200 on Swiggy and a max. discount per offer is Rs. 250.

Keep in mind that in India, you can enjoy contactless transactions up to Rs. 5000 without needing a PIN with this card. However, when using the card abroad, for contactless transactions up to Rs. 5000, you will be required to enter your PIN.

Daily transaction limit in India and abroad

- Purchase limit is Rs. 4,00,000

- ATM withdrawal limit is Rs. 2,00,000

3. Best debit card Issuers in India

The debit and the credit cards that are most popular in India are Mastercard, Visa and RuPay card.

Let us delve into a more comprehensive understanding of these aspects.

A) Mastercard Tap and Go

As one of the most widely recognized card issuing brands in India, Mastercard holds the distinction of being the largest card issuer globally. In India, Mastercard offers a range of contactless debit, credit, and prepaid cards.

It has established partnerships with both private and public sector banks in India.

The noteworthy aspect of Mastercard Tap and Go is, its universal usability, allowing you to use it seamlessly both within India and abroad.

B) Visa PayWave

Similar to Mastercard, Visa is one of the foremost issuers of debit and credit cards globally. Notably, it holds the position of being the largest provider of contactless credit and debit cards in India.

C) RuPay contactless card

Developed by NPCL, this contactless card operates on NFC technology, enabling users to utilize card details on NFC-enabled wearables for seamless contactless transactions.

A simple tap on a Point of Sale (POS) terminal completes the payment process swiftly.

However, the limitation lies in its geographical usage, as unlike Mastercard and Visa, RuPay cards are exclusive to transactions within India.

4. Popular contactless payment Apps in India

In the realm of tap-and-pay services in India, various options cater to different user preferences.

iPhone users can check out Apple Pay, while Android users have plenty of choices like BHIM, Google Pay, PhonePe, Paytm, Samsung Pay, PayPal, and others. These apps make it simple for you to do contactless payments in a way that works best for you.

5. Make contactless payment on phone

Making contactless payments has become incredibly easy and quick nowadays. If you’re a first-time user, all you need to do is set up an app on your phone to enable tap-and-pay functionality.

Here are the steps that you need to follow –

STEP 1 – The first step in enabling contactless payments is to install the app that offers this feature. Choose from options like PayTm, Samsung Pay, PhonePe, Google Pay, or Apple Pay and get started.

STEP 2 – Open the installed app and add your debit card details.

STEP 3 – The bank will send you a verification code through text message or call or an email to your email account.

STEP 4 – Add the code and the card is all set up and now you can use your phone to make payments.

For Google Pay users, I’ve included the link from Google‘s official website to provide a clearer understanding.

Now at the time of making payments

- You need to enter a password (that you have created) or use facial recognition to open the app. In the case, if someone’s phone is lost or stolen, the transactions can not be done without the owner. That’s why this step is included for security purpose.

- Now just tap your phone to the POS and make the payment.

6. What are the benefits of a contactless debit card for consumers?

The main benefits include –

A) Faster transactions

Picture a busy shopping mall, everyone in line with heaps of items. You’re in the midst of it, and so are others, waiting their turn.

Now, think about this: if the transactions were quick, you wouldn’t have to wait in that long line. That’s where contactless payments come in handy.

Unlike other methods, they don’t make you go through a bunch of steps. Just a quick tap, and you’re done.

Imagine the relief, no more waiting, and everyone happily moving through the checkout. It’s like a magic trick, making shopping smoother and faster for everyone in the mall.

Tapping and Paying is just a matter of seconds.

B) Secure payment

As these transactions are protected by end-to-end encryption, you don’t have to worry about using this payment method. It is much more secure than any other method.

C) Ease of use

Along with other benefits, it stands out as the quickest and simplest method available. All it takes is a quick hover or tap of your phone on the POS, and your payment is effortlessly completed.

7. Contactless payment limit for transactions

Making a contactless transaction with your card is super easy. No need to enter your PIN for purchases up to Rs. 5000. After that for any contactless transaction, just enter your PIN, and you’re good to go!

Before 2021, the maximum limit for contactless transactions without entering the PIN was Rs. 2000. However, the Reserve Bank of India increased this limit to Rs. 5000, and this change became effective from January 1, 2021.

The decision to increase the limit was prompted by the Reserve Bank of India’s continuous monitoring of the rising trend in contactless payments. With more people opting for this technology, a noticeable shift in consumer behavior has occurred, largely influenced by the convenience and safety it offers, especially in the context of the COVID-19 pandemic. Now, individuals can simply tap their cards and enter their PIN, reflecting an adaptation to the changing dynamics of how transactions are conducted.

8. Consumers concerns related to contactless payment.

A) Low transaction limit

According to RBI, there’s a limitation with contactless payments—up to only Rs. 5000 per transaction without requiring a PIN. This restriction might pose a concern for consumers, potentially impacting their shopping experience.

B) Limited international availability

As per American express, there are some mobile wallets that are not accepted internationally and in some cases you may also incur an additional foreign transactional fee.

C) Security concerns

The absence of a PIN requirement for transactions up to Rs. 5000 raises a significant concern for potential fraud activities if your card is lost or stolen.

If your card is lost or stolen, it’s crucial to act swiftly. Contact your bank immediately, request to block the card, and report the incident. Most banks offer a 100% fraud guarantee in such situations, ensuring your protection. It’s advisable to inform them promptly and have your card blocked for added security.

D) Technical concerns

You can Tap and pay using your mobile only when your mobile and the payment terminal both are NFC enabled. If they are not, you will find trouble using this payment method.

Conclusion

In conclusion, embracing contactless payment methods presents a compelling case for individuals seeking convenience, efficiency, and enhanced hygiene in their financial transactions.

The benefits of contactless payments, such as speed, ease of use, and reduced physical contact, have become increasingly apparent.

With the ability to make swift and secure transactions through a simple tap or wave, users save time and enjoy a seamless payment experience.

However, it is essential to remain vigilant to potential threats such as unauthorized transactions and cyberattacks. Adhering to security best practices, staying informed about emerging risks, and utilizing advanced technologies are crucial steps in mitigating these potential challenges.

Ultimately, the numerous advantages of contactless payments make them a prudent choice for modern consumers seeking a safer, faster, and more streamlined financial experience.

Understanding Stripe’s policies helps you avoid problems and follow the rules.

Aloha, makemake wau eʻike i kāu kumukūʻai.